Still have questions?

Get in touch with us

IRMAA - (Income-Related Monthly Adjustment Amount)

|

|

|

|

|

|

|

Important Points

IRMAA can impact your premiums for Medicare Part B and Part D. It is an extra charge for people with higher incomes.

IRMAA is based on your Modified Adjusted Gross Income, such as taxable Social Security, retirement distributions, rental income, and more.

You can appeal and IRMAA surcharge using Form SSA-44 if you have a qualifying life-changing event.

Planning for Medicare can be a daunting task, from accessing your own healthcare needs to the financial impact it can have on your retirement. One important aspect to consider is the Income-Related Monthly Adjustment Amount (IRMAA). It has the potential to raise your cost of Medicare Part B and Medicare Part D.

Choosing the proper Medicare plan, while keeping IRMAA in mind takes some strategic planning. It is crucial to understand how different income streams can impact your Medicare premium. In this article we will dive into all things IRMAA and what you need to know as you approach your retirement and Medicare eligibility.

Mohring Insurance Services LLC | Talk to a Medicare Expert at (866) 440-1885

What is IRMAA?

IRMAA stands for "Income-Related Monthly Adjustment Amount." It can affect your premium for Medicare Part B and Part D. Each year the federal government decides what the standard premium will be for Medicare Part B.

For those with higher incomes, this is where you will run into IRMAA. IRMAA adds an extra charge to your monthly premium for Part B and Part D if your earnings exceed a certain amount. Social Security determines the threshold for this amount every year.

How to Calculate IRMAA

IRMAA is based on your Modified Adjusted Gross Income (MAGI) and it takes into account your adjusted gross income. It is always determined by your tax return from two years prior. For example, your 2025 IRMAA would be based on your 2023 tax return.

Tax brackets and Medicare premiums change each year and typically go into effect on the first of the new year. Unlike when you file your taxes, Medicare premiums are per person. There is no joint Medicare plans for husband and wife, they are all individual. This could mean that both partners could be subjected to IRMAA and have to pay a higher premium on their Medicare plan.

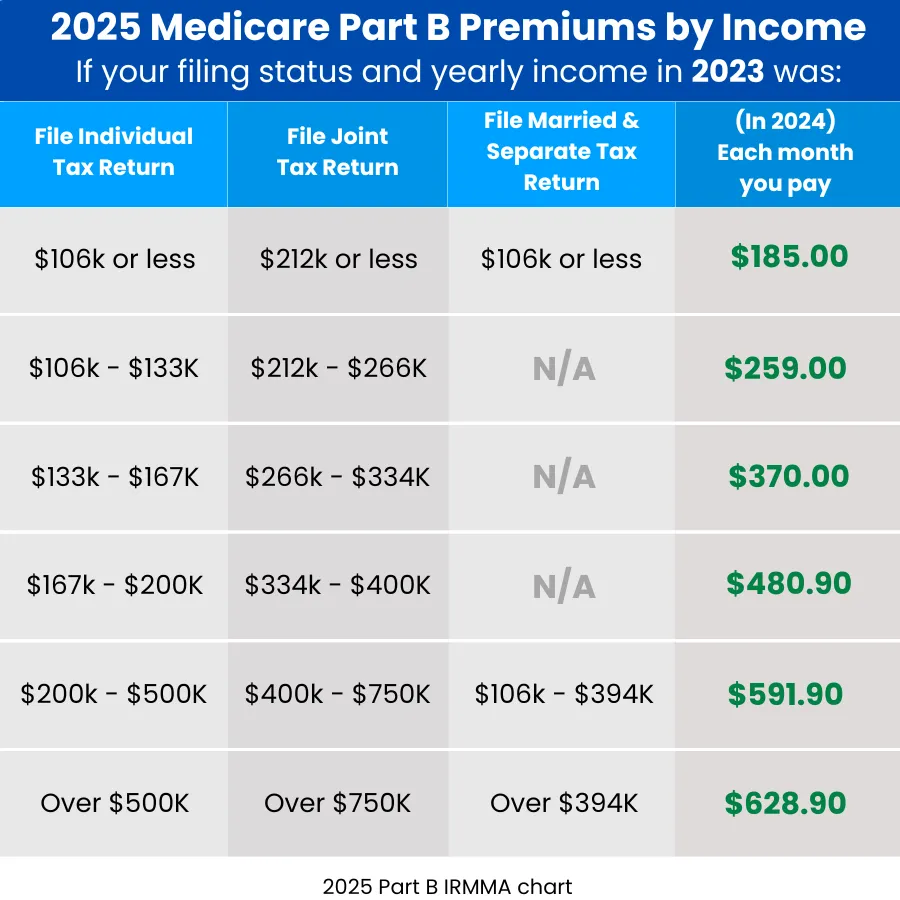

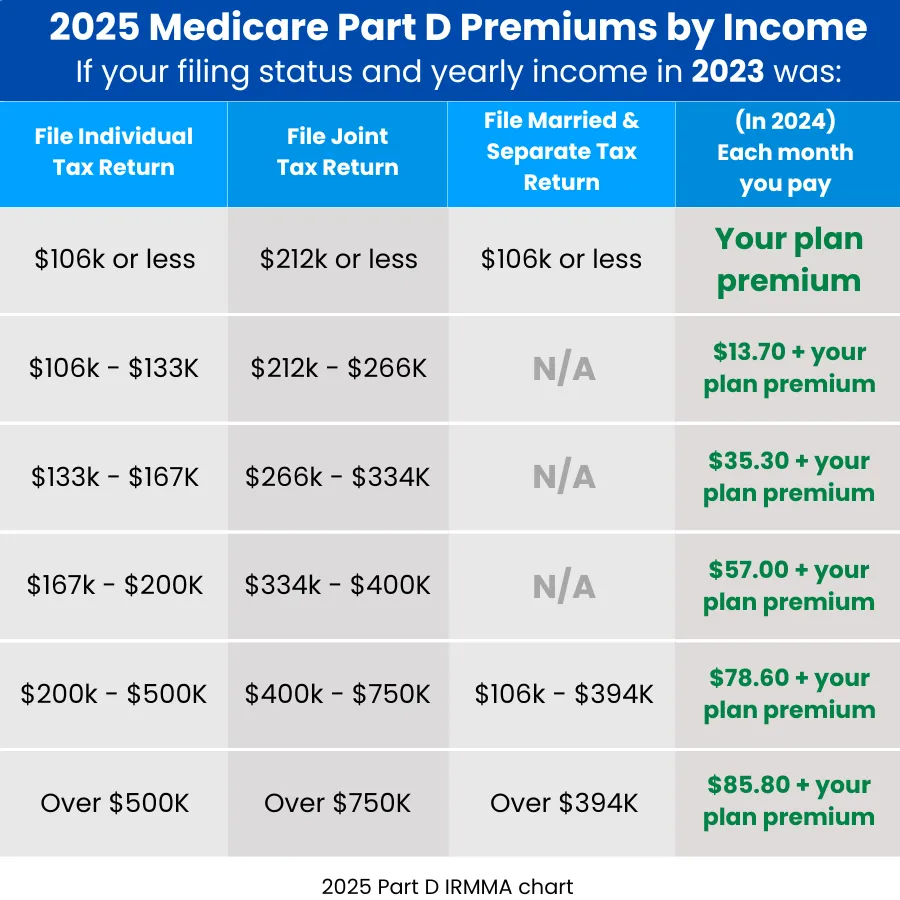

Below is a table to illustrate how IRMAA would affect your Medicare premiums.

Will I Be Subject to IRMAA?

If your MAGI goes over a certain threshold, you might be subject to IRMAA. The amounts depend on whether you're an individual or a couple that files jointly. Social Security will send annual letters letting you know if you will have an IRMAA surcharge.

What is MAGI?

The term MAGI stands for "Modified Adjusted Gross Income" and it includes multiple income sources that help determine this number. This includes your adjusted gross income (AGI) from your tax return and also accounts for earnings from wages, investments, self-employment, rental properties, and any other sources of taxable income.

Here are some examples of income categories that contribute to your MAGI:

Capital Gains: Profits from selling investments like stocks, bonds, or real estate may have an impact.

Foreign Income: Income earned abroad, including pensions and rental income, may have an impact.

Interest & Dividends: If they are taxable, they can affect your MAGI.

Rental Income: Income earned from rental properties, after deducting allowable expenses, may have an impact on your MAGI.

Retirement Distributions: Distributions from tax-deferred retirement accounts like 401(k)s and traditional IRAs may increase your MAGI. Roth IRA distributions are usually not included.

Taxable Social Security Benefits: If your combined income, including half of your Social Security benefits, crosses a certain threshold, a portion of your benefits may become taxable and be included in your MAGI.

Trusts & Estates: Distributions from trusts and estates can affect your MAGI if they are considered taxable income.

It is crucial to always refer to the most recent IRS guidelines and Medicare rules when calculating your own MAGI.

When should I worry about IRMAA?

IRMAA is based on your tax return from two years prior. The Social Security Administration looks back, usually at the beginning of each year. This helps ensure that your Medicare premiums align with your most recent income.

Can I Appeal an IRMAA Letter?

Yes. If there has been an error in calculating your IRMAA, you can try to appeal the decision. If you qualify for a life-changing event, you can use Form SSA-44 to file an appeal to the decision. Examples of life-changing events include marriage, divorce, the death of a spouse, work reduction or retirement, and more. The Social Security Administration will consider these changes during the appeals process.

When can IRMAA be appealed?

If you receive a letter stating that you will have an IRMAA surcharge, you can file an appeal using Form SSA-44. You can complete the form and submit it to your local Social Security Office for processing. This appeal will need to be completed within a 60-day window from the time you receive your IRMAA notice.

If you miss the deadline, you can still try to file an appeal. However, you may want to provide a well-documented reason for the delay in addition to any relevant information that will support your appeal.

When Will My Appeal Be Approved?

Unfortunately, Social Security is not known to be consistent with an exact time frame. It can take them up to 90 days to process and IRMAA appeal. However, you can always call and see if there are any updates. If your appeal is approved, you will receive a letter in the mail, and Social Security should issue a refund for the additional amount you paid on your premium so far.

Paying IRMAA

Most Medicare beneficiaries tend to receive quarterly invoices for their Medicare premiums. The initial IRMAA charges may also arrive on a quarterly basis.

If you are subject to an IRMAA surcharge, there is a chance that the bill will arrive separately from your regular Medicare premium bill. Keep an eye out for this as you will want to make sure that both get paid. However, this is typically only during the initial billing. Eventually they will align and come together.

KEEP IN MIND: Social Security is not known to be very consistent. Since they re-evaluate every year, it is possible that you could get hit with IRMAA again in a later year, even after a successful appeal. If this happens to you, you can appeal again but you will want to make sure to continue to pay their bills on time to avoid any lapses. If the new appeal is approved, a refund will be issued.

Can it come out of my Social Security Benefits?

Yes. Just like your Part B premium, you can elect to have your IRMAA surcharge deducted from your Social Security check.

Is IRMAA Forever?

Fortunately, IRMAA is not a lifelong charge. It is reevaluated each year based on your tax return from two years prior. If your income falls below the threshold, your IRMAA can decrease or be eliminated. A tax planning strategy should work well to help navigate this.

Additionally, you can also appeal IRMAA every year if you believe you qualify for a life-changing event and have documentation to back up your case. Having a substantial decrease in income can help trigger a successful appeal.

Plan Ahead

As you get closer to retirement and Medicare eligibility, there are several proactive tactics that can help you navigate through these complicated financial matters.

If you think you might be subject to IRMAA surcharges, you should consider initiating the appeal process early and setting aside funds to cover these potential costs during the appeal process. This might help to minimize any financial strain and make for a smoother appeal process.

Keep in mind your individual timeline for Medicare enrollment. In many cases, you can take proactive steps to limit your income prior to becoming eligible for Medicare. This could involve things like selling a property, relocating, managing withdrawals from retirement accounts, and more. Keep in mind that IRMAA is determined from your tax return from two years prior, so you will want to think about making these moves around 62 or 63 years old.

IRMAA can be complicated, but you can take steps to plan ahead. By understanding the calculation, impact, and appeal process, you can make proactive decisions that align your healthcare coverage with your financial situation.

Key Points

Starting appeals early, setting aside funds, and considering financial moves are ways to be proactive about an IRMAA surcharge.

IRMAA is reevaluated each year based on your tax return from two years prior. If you income falls below the threshold, you may reduce or eliminate your IRMAA surcharge.

Initially, IRMAA charges may arrive separately from your regular Medicare premium bill. Continue paying all bills during an appeal process to avoid any lapse in coverage. A refund will be issued if your appeal is approved.

At Mohring Insurance Services LLC, we are happy to offer assistance with Medicare when you choose to enroll. Give us a call at (866) 440-1885, or to schedule a free consultation, click the link below:

© 2025 Mohring Insurance Services LLC All Rights Reserved.

MyMedicareFacts.com is a free-to-use information website by Mohring Insurance Services LLC. All insurance agents and enrollment platforms linked to this site have their own terms and conditions.

This is a promotional communication.

Calling our phone number will connect you to a licensed broker who is trained and certified to help you review the plan options available in your area. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact MEDICARE.gov or 1-800-MEDICARE to get information on all your options.

Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

To send a complaint to Medicare, call 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day / 7 days a week). If your complaint involves a broker or agent, be sure to include the name of the person when filing your grievance.

MyMedicareFacts.com is the web and phone-based insurance portal utilized by Mohring Insurance Services LLC. Beneficiaries may be connected by licensed insurance agents of Mohring Insurance Services LLC who are licensed to transact business as insurance agents in your state.

Not all licensed insurance agents with Mohring Insurance Services LLC are licensed to sell all products. Service and product availability varies by state. Agents of Mohring Insurance Services LLC work with Medicare enrollees to explain Medicare Advantage, Medicare Supplement Insurance, and Prescription Drug Plan options. Agents of Mohring Insurance Services LLC are licensed and certified representatives of Medicare Advantage HMO, PPO, and PPFS organizations and stand-alone prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Licensed insurance agents may be compensated based on a consumer's enrollment in a health plan. No obligation to enroll. Licensed agents cannot provide tax or legal advice. Contact your tax or legal professional to discuss details regarding your individual business circumstances. Our quoting tool is provided for your information only. All quotes are estimates and are not final until consumer is enrolled.

Please call our customer service number or see your Evidence of Coverage for more information, including the cost sharing that applies to out-of-network services.

Medicare has neither reviewed nor endorsed this information.

Licensed insurance agents required to comply with all applicable federal laws, including the standards established under 45 C.F.R. § 155.220(c) and (d) and standards established under 45 C.F.R. § 155.260 to protect the privacy and security of personally identifiable information.

The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, sex, sexual orientation, gender identity, or religion. To learn more about a plan’s nondiscrimination policy, please contact the plan.

For a complete list of available plans please contact 1-800-MEDICARE, TTY 711, 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare beneficiaries may also enroll through the CMS Medicare Online Enrollment Center located at www.medicare.gov.

Every year, Medicare evaluates plans based on a 5-star rating system.

You are not required to provide any health related information unless it will be used to determine enrollment eligibility.

MyMedicareFacts.com is not connected with or endorsed by the United States government or the federal Medicare program.

© Mohring Insurance Services LLC. All trademarks and service marks are the property of their respective owners and used with permission.

Rates are reviewed periodically and are subject to change in your state.

Cost Estimates are based on the information entered, using data about past experiences by beneficiaries with similar attributes and the premiums and benefits provided by the plan. Actual costs may vary. Monthly medical costs are represented by annual figures divided evenly per month.

Licensed sales agents/producers may be compensated based on your enrollment in a health plan.

Medicare Supplement Plans are not connected with or endorsed by the U.S. Government or the federal Medicare program.

For plans that provide drug coverage, the formulary may change during the year.

Medicare beneficiaries may also enroll in Medicare plans through the CMS Medicare Online Enrollment Center located at https://www.medicare.gov.